Care facility accused of fraud over funeral policy

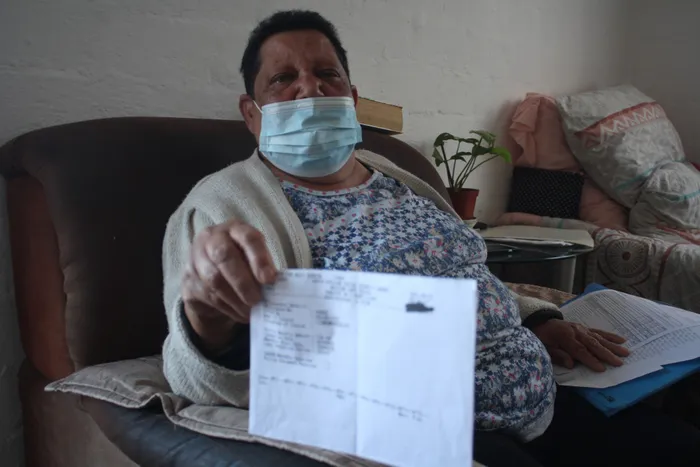

Julia Dyson, 71, shows the document she was given at SASSA, confirming that her husband had a funeral policy. She says she was unaware of this policy until after her husband died. The policy’s underwriter says its investigation concluded the policy was taken out fraudulently.

A Heideveld pensioner has accused a Mitchell’s Plain frail-care facility of fraud after it listed one of its former board members as the beneficiary of a funeral policy it took out on her husband - a policy she says she knew nothing about until after his death.

Julia Dyson, 71, says her husband, Sidney Dyson, needed full-time care after he had a stroke a few years ago. Unable to give him the care he needed, Ms Dyson admitted him at Beaconvale Frail Care Centre in Beacon Valley in July 2016.

Mr Dyson died in June this year.

The widow says she grew suspicious when she reported his death at the South African Social Security Agency (SASSA).

“The official at Sassa told me that money for a funeral policy was deducted every month from my late husband’s pension from August 2016. I did not know about this. I had no control over his pension, as the money went straight to the care facility.

“I was given the print-out confirming that money was deducted for a funeral policy. I then proceeded to contact the insurance company, who gave me the name of the beneficiary. After more enquiries, I learnt that the beneficiary is a carer at Beaconvale. I have since, without any luck, tried to resolve this. My husband was not in a mental capacity to give consent for any legal transaction, and we were married in community of property. Not once was I consulted about this,” Ms Dyson said.

The couple were married for 50 years, and Ms Dyson said that her husband had only ever signed one funeral policy early on in their marriage. Since then, he had refused to open any other funeral policy, because he had believed that “they were all skelm”.

By the time he moved to Beaconvale, Mr Dyson had a speech impediment and memory loss. He did not remember their children, Ms Dyson said.

The chairman of Beaconvale Frail Care Centre’s board, Solomon Philander, confirmed that funeral policies were taken out for some residents and that the beneficiary listed for Mr Dyson’s policy was a former acting chairperson of the board. The name is known to the Athlone News.

“Prior to my tenure as chairperson, in March 2017, the organisation was forced to approach a funeral underwriter to assist to cover the residents, as this became an unplanned expense for the organisation. Families had the tendency not to support their loved ones when they were taken up at the facility,” Mr Philander said.

Families were aware that the full Sassa pension was payable directly into the Beaconvale bank account, he said.

“Families are aware that 90% of the Sassa pension is a contribution to the facility to cover accommodation, nursing care, three meals and all other expenses. Residents do get the 10% as pocket money, and families are encouraged to assist the resident,” Mr Philander said.

He believes the facility should get the policy payout because “in principle, the policy was taken out and paid by the organisation”.

Mr Philander added: “The underwriter, who needed a beneficiary to the funeral cover, recommended Beaconvale nominate a person, as they are not able to make the beneficiary an entity, hence the proxy in the form of the person was nominated by means of the chairperson of the board as the beneficiary. The organisation paid the 10% monthly to the resident, which means the organisation honoured their obligation. Beaconvale paid for the funeral cover, and hence the claim of the policy should be seeded to the organisation

“In many cases, families are not willing to provide us with funeral documents for us to claim, even if they know that they did not pay for the policy and it is not their money. The money will be paid into the account of the organisation to continue to provide a service to the frail in our care.”

Faizel Cariem, the chief executive officer (CEO) of LionLife, the policy’s underwriter, confirmed that the insurance company had instituted an investigation after Ms Dyson’s complaint. According to Mr Cariem, the investigation concluded that the policy - which was sold by another insurance company - was taken out fraudulently because none of Mr Dyson's family knew the beneficiary and Mr Dyson was not of sound mind when the policy was taken out.

“As the policy was taken out fraudulently, Ms Dyson cannot benefit from an illegal activity. However, Ms Dyson will be refunded all the premiums that were received on this fraudulent policy.

“We are currently reviewing if any other policies are linked to the carer or the frail-care facility and will take the necessary action once this investigation has been concluded,” Mr Cariem said.

Nolitha Jali, from Legal Aid South Africa, said Ms Dyson could open a fraud case at SAPS.

According to Ms Jali, the common terms and conditions of similar policies allowed the policyholder to choose their beneficiaries.

“Only in the case where the policyholder has not elected any person as a beneficiary, will the proceeds of the policy go directly to the estate of the deceased. Ms Dyson, or the executor of Mr Dyson’s estate, are entitled to have access to the document (when the policy was taken out). Without a proper investigation being conducted, it is not easy to predict the implications, hence it becomes important that one be thoroughly conducted by the relevant authorities before anyone can reach a conclusion about such a matter,” Ms Jali said.

Esther Lewis, spokesperson for the Department of Social Development (DSD), said her department would also investigate the complaint.

“Usually homes facilitate a process towards obtaining a funeral policy for an older person if it’s not in place when they are admitted to a facility. However, it should be done with the knowledge and approval of the family members.

“All funded old-age homes are registered with Sassa and get a pay-point number in which the resident’s pensions are being paid. The homes deduct their fees and administrate the rest of the money by paying funeral policies, etcetera. The rest is used by the older person to buy toiletries, or snacks, for example,” Ms Lewis said.

Ms Lewis, however, could not confirm whether the payout should be made to the facility or the family of the deceased.